PTC India Limited – Long Term Investment Buy

(Capacity Additions Leading to Increased Revenue Visibility with Better Margins)

-Mr. Adesh Doifode

Abstract

PTC India Limited (PTC), leading power trader in India, is well placed to benefit from long term dynamic changes in the power sector. Increasing capacity additions in power generation will fuel trading opportunities and further leading to long term Power Purchase Agreements (PPAs) with better margins and improved long term revenue visibility. Thus capacity additions to trail demand growth fueling power trading opportunities in the long run. Continuous increase in per capita consumption of electricity in India, regional and peak power deficit to create trading

Apart from power trading in the domestic market PTC is also the authorised entity for cross border power trading (CBT). CBT had contributed more than 14% to its total volumes which includes importing power from three hydro-electric projects of Bhutan (PPAs of 1420 MW) while exporting power to Nepal (PPAs of 150 MW) and recently started exporting power to Bangladesh (250 MW), while PTC is also supplying 250 MW power to Bangladesh resulting in trading volume of 1624 MU.

Upside Risks:

Monetization of its investments in next 2-3 years

Addition of PPAs to the existing contracts to boost volumes

Better than estimated volumes are expected

Improved share of profits from sale of power from its joint ventures and investments in power generation

Improved margins in short-term bilateral segment

Key Words: Equity, Equity Research, Fundamental Research, PTC India, Power Trading

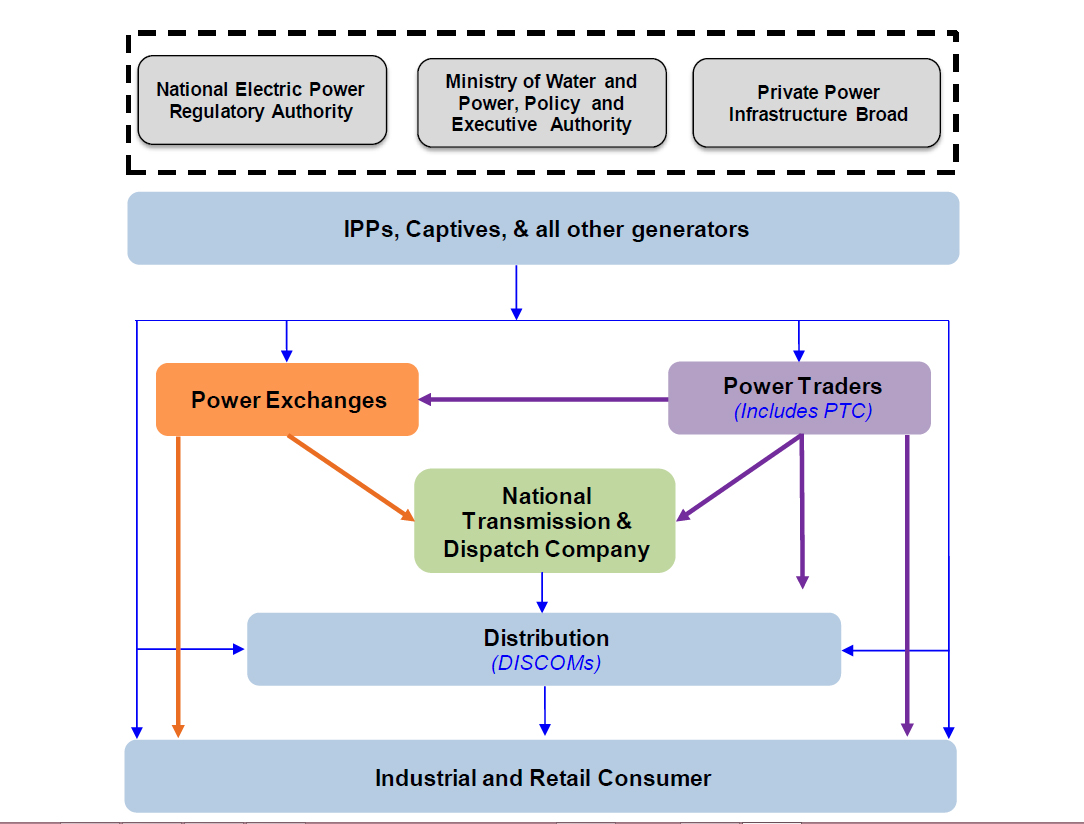

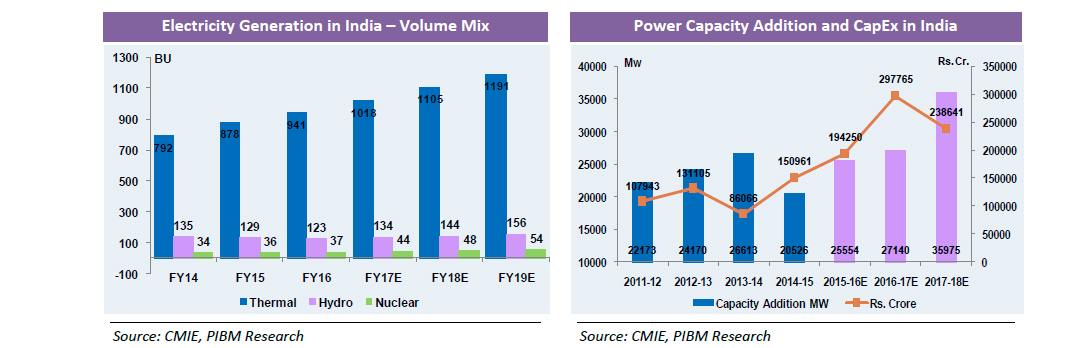

The power sector in India has witnessed credible growth in FY16 meeting the targets for generation growth, capacity addition and successful auctioning and allocation of a number of coal blocks. Power is one of the most critical components of infrastructure crucial for sustained economic growth. The policy level developments in the power sector are opening up many opportunities for business and investments in coal mining, supply to retail consumers, energy efficiency services and development of renewable energy projects. Electricity demand in the country has increased rapidly and is expected to rise further and thus massive addition to installed capacity is required. The Government of India is working on a mission to achieve electrification of remaining 20,000 villages by 2020 through measures like off-grid solar power generation.

Power trading, in general, is a risky task as the commodity (electricity) is quite different from other commodities due to the fact that it is non-storable, it depends on the supply-demand balance and it also faces a lot of transmission constraints. Historically the electricity traded through traders is sold at better prices than on power exchanges. While we have observed that the per unit rates on power exchanges has reduced at a higher pace than those traded through traders. PTC has entered in to more than 12GW of PPAs, which will improve LTT segment volumes leading to improved profit margins. Long term trading (LTT) segment is the key to PTC’s performance in the long run, which will drive overall PTC’s volumes and uphold its core trading margins as PTC gets higher margins ~7-8 paise trading margin in LTT segment as compared to ~2-4 paise in STT segment.

Objective

To identify equity investment opportunity in power trading sector through fundamental research.

Methodology

Fundamental research done in this report involves study of historical financial performance of the company for past five years, analysis of industry (electricity trading) and other macro factors like economic, political, global, etc. Have studied in detail publicly available information viz. annual report, company presentation, investor / results presentation, corporate announcements, notices and disclosures, news, press releases, company updates, etc. It also involves use of secondary data from CEA, CERC, CMIE, Bloomberg, etc., which was referred to understand the industry dynamics for detailed analysis.

Company Background

PTC India (PTC) was established in 1999 with the sole objective to buy power from power surplus states and sell it to power deficit states through State Power Utilities & Licensees. As market dynamics changed PTC diversified into being an integrated entity with entry into coal trading, power project development and financing. PTC had around 33% market share in power traded through bilateral and power exchanges (IEX & PXIL) during FY15. PTC’s trading portfolio is bifurcated in to three major segments viz. short term trading (STT) (contract less than one year), long term trading (LTT) (contract more than one year), cross border trading (CBT) (contract for power trading outside in India).

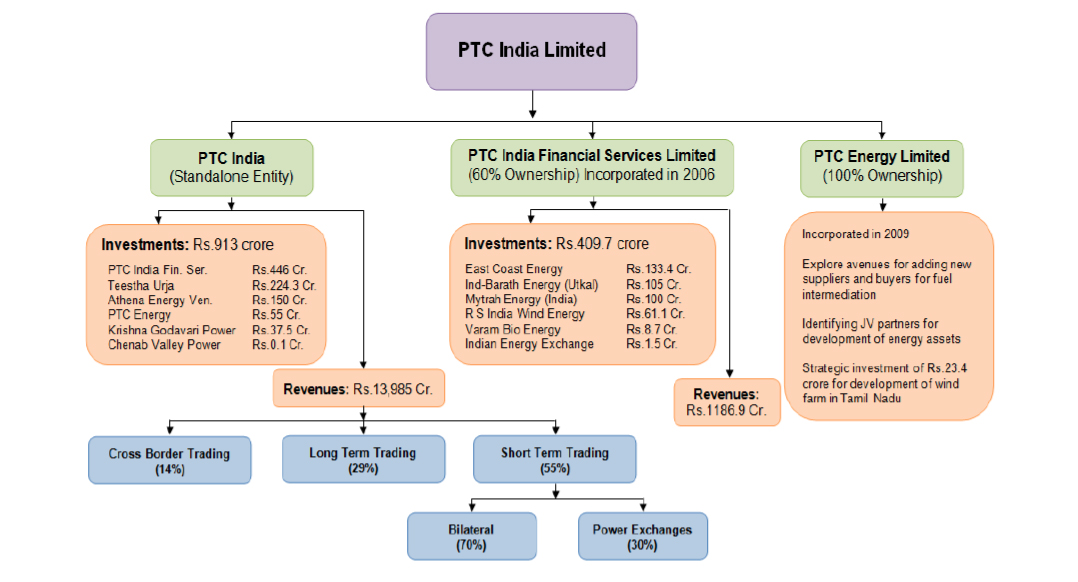

In the LTT segment PTC enters in to long term PPAs and back to back Power Sale Agreements (PSAs) with Independent Power Producers (IPPs) and State Electricity Board’s (SEBs) respectively to trade power. PTC has two subsidiaries viz. PTC India Financial Services Limited (PFS) and PTC Energy Limited (PEL). PTC owns 60% stake in PFS, a non-banking financial institution (NBFC) which further had made principal investments in, and provide financial solutions for companies with projects across its energy value chain. PFS provides both equity / debt financing including structured products.

PEL is 100% subsidiary of PTC with main role of importing fuel and onward sale to power plants under tolling arrangements, supplying coal under different structures i.e. on Spot, Short, Medium or Long Term basis. Currently it is exploring avenues for adding new suppliers and buyers under its umbrella of fuel intermediation on competitive basis. It is also identifying joint venture partners for development of energy assets viz. it has undertaken strategic investment (Rs.23.4 crore) for development of wind farm in Tamil Nadu, 20 MW wind power project to be set up at Nipaniya in Madhya Pradesh, 30 MW turnkey wind power project at Jaora in Madhya Pradesh.

Business Structure

Domestic Capacity Additions to Trail Demand Growth Fueling Trading Opportunities in the Long Run

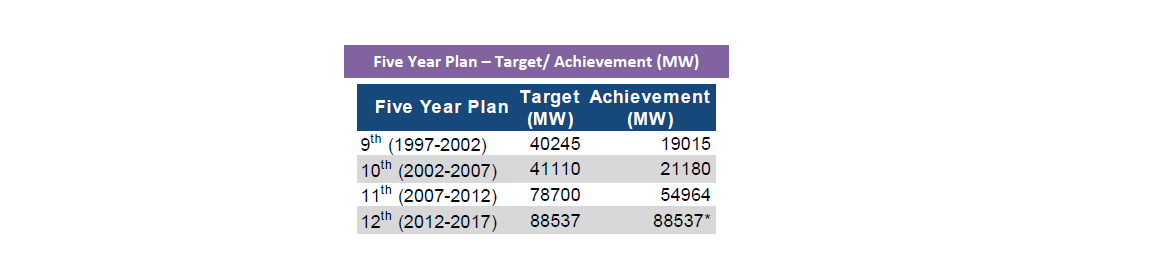

India being a perennially power deficit country had elevated capacity addition plans in every five year plan in the past, but has always been far away from achieving it mainly due to delays in the placement of equipment orders and acute fuel (coal) shortages. In the 12th five year plan it is more likely that the target of 88.5 GW will be achieved, as according to the Central Electricity Authority (CEA), orders for manufacturing and commissioning of the entire 88,537 MW capacity have been placed within the first 14 months as compared to 30 months in the previous five year plan. The capacity added till April 2016 is 86250.7 MW against 88537 MW envisaged in the twelfth five year plan, while a capacity of 16654.4 MW is expected to get commissioned in FY17. Hence the power capacity addition target set in the 12th five year plan will be smoothly achieved and likely to exceed the targeted capacity addition.

PTC well Placed to Benefit from Long Term Dynamic Changes in the Power Sector

PTC being the leading power trader in India is likely to benefit from increasing capacity additions in power generation fueling trading opportunities, further leading to long term PPAs with better margins and improved long term revenue visibility. Historically the volumes traded by PTC have grown at a CAGR of 20% while it is expected to grow at a CAGR of 31.5% in FY17E-FY19E period improving the profitability in coming years.

In terms of time spent on these networks, among the survey participants, most of the people preferred to spend majority of their time budget on Facebook. This again shows the importance of Facebook among Indian youths. The next most used network is WhatsApp. For some of the users, time spent on Youtube is very high. This may be because they have subscribed to some specific channels where new videos are added very frequently.

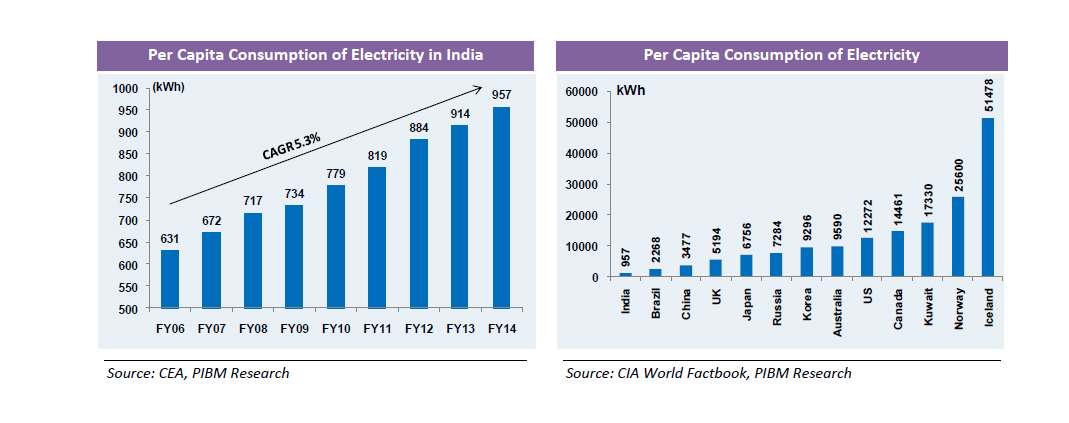

The per capita consumption of electricity in India is increasing at a CAGR of 5.3% during past 8- 9 years which will maintain the demand-supply gap in the power sector and will keep fueling the electricity demand in the long-run leading to more capacity additions and traded volumes. The per capita consumption of electricity in India is very low at 957 kWh annually as compared to other developed and developing countries indicating enormous upside (demand potential) in the long-run.

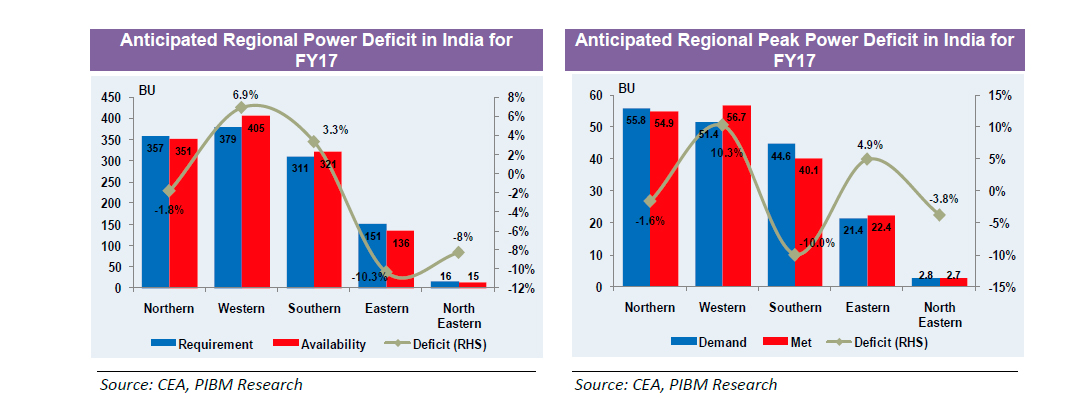

Regional & Peak Power Deficit to Create Trading Opportunities

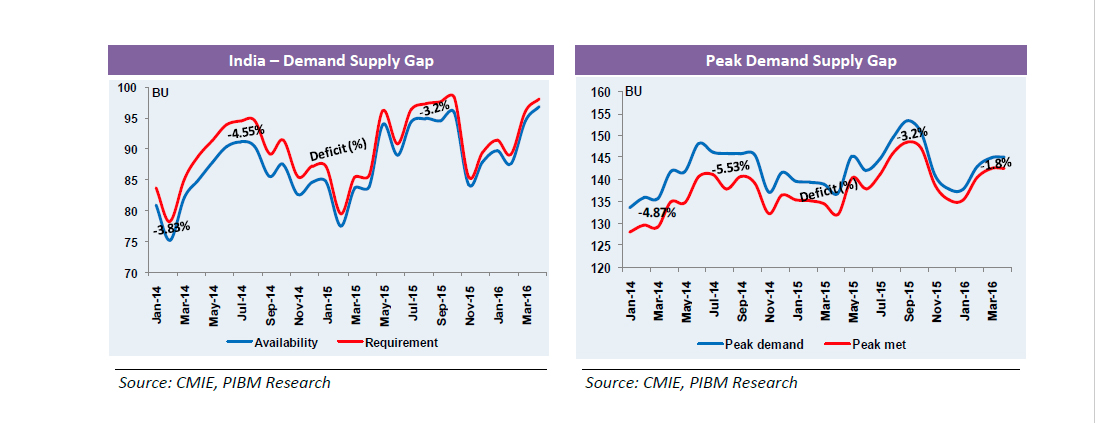

The regional and peak power deficit scenario in India is perpetual as power cannot be easily moved from areas of surplus to those in deficit and will always create trading opportunities in the STT segment. Historically the deficit has been more in southern and northern region in India at 1.6% and 4.8% respectively in FY16, whereas the peak deficit in northern region is likely to be very critical at 7.1% for FY16. CEA has anticipated power demand-supply position in the country for FY17E where the power deficit in eastern and northern region foreseen is 10.3% and 1.8% respectively, whereas the peak deficit anticipated in the southern region for FY17E becomes more critical at 10%.

In the past there has been a pervasive electricity deficit in the range of 5% - 7% while it has reduced in past two quarters to around 2%. India’s peak power deficit in 4Q FY16 was 2516 MW or ~1.76% which was much lower than recorded in August 2014 (5.5%). The power ministry had projected that there won’t be any electricity supply deficit for FY17 while the improvement in deficit situation is due to decreased power demand mainly from agricultural & industrial customer and increase in capacity addition in FY14-FY16. The diminishing gap between demand and supply is a short term phenomenon and it is likely to be in the range of 5% - 12% in the long-term.

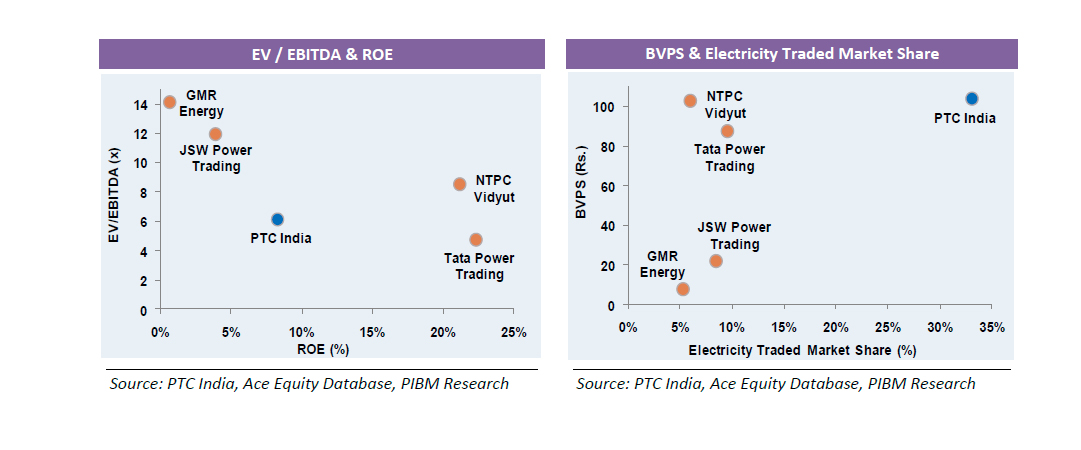

Peer Comparison:

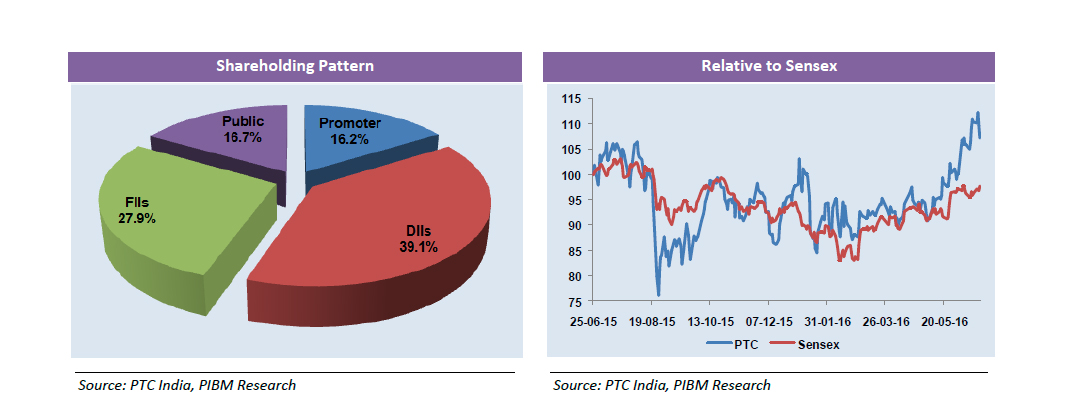

PTC has stable ROE of 8.3% and better EV / EBITDA of 6.2% as compared to its peers who are in to trading of electricity in the STT and LTT segment. PTC being the market leader in the electricity traded segment in India garners the highest share of 33.1% (FY16) in the STT segment, while has the highest BVPS Rs.104.1 making it attractive for investment.

Risks and Concerns:

Appreciation of the INR could adversely impact the profitability of the company as its overseas business pie has increased significantly.

Delays in execution of order book and slowdown in new order inflows could lead to lower revenue than our estimates

Key Financials:

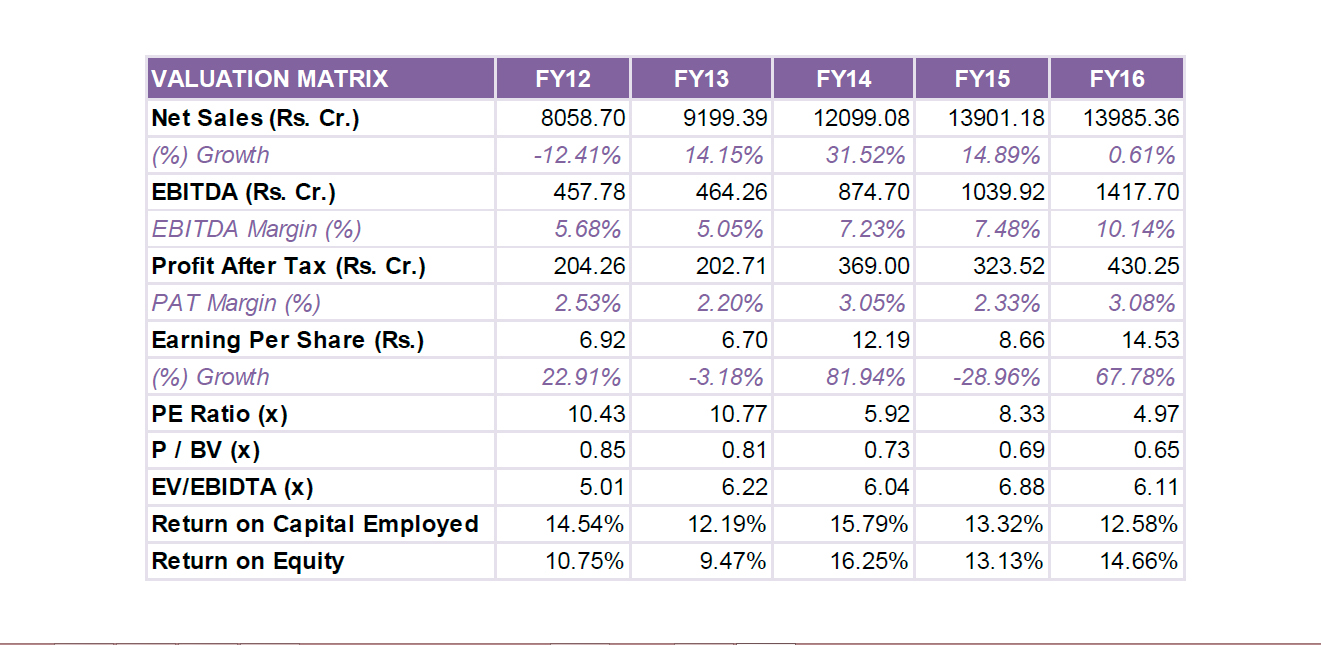

It is suggested to BUY PTC with a target price of Rs.97.4, representing a potential upside of ~35% over a period of 18 months. At the CMP of Rs.72.2 the stock is trading at an attractive valuation of 8.3x and 5.0x on its FY15 and FY16 EPS of Rs.8.7 and Rs.14.5, respectively and on an EV/EBITDA basis, the stock is trading at a multiple of 6.9x for FY15 and 6.1x for FY16.